Vouchers St. Albans

At Forward Finance, we offer our ever-popular high street vouchers to our customers in and around the St. Albans area. Paid back similarly to our loans, you can choose the amount you require and pay them back over a period that works for you.

Our vouchers come in the form of Love2Shop Vouchers, which are one of the most well-known and accepted types of vouchers in the country. Should you be interested in applying for vouchers in St. Albans, be sure to contact us today.

Love2Shop Vouchers

Love2Shop vouchers are the perfect gift for birthdays, weddings, Christmas presents, and other special occasions. They can be used at 85 big-name retailers across the UK, like Argos, Goldsmiths, Boots, Halfords, and Debenhams.

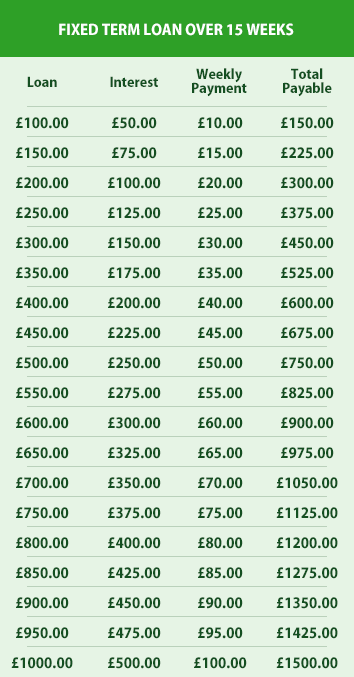

Forward Finance can provide you with Love2Shop vouchers from £100 which can be paid back through your local agent or by debit card or standing order. Love2Shop vouchers can be spent at over 20,000 locations in the UK. These vouchers can be spent in a number of locations, which can be found here.

How it Works…

Applying for a voucher loan has never been simpler with Forward Finance, you can apply for your high street voucher in three easy steps:

- Choose Your Loan Type – First of all, you need to work out whether you want a cash loan or a Love2shop card, and how much you’d like to borrow, you can do this by using our online calculator or contact our friendly team members today!

- Fill Out Your Application Form – If you pass the pre-application check, you’ll be taken to a simple form to fill out your details. Once your application has been processed you will either get an immediate decision or one of our Customer Care team may call you to discuss your options.

- Receive your Cash or Love2shop Card – Once you’ve been accepted in principle, one of our friendly agents will personally visit you to complete a full income and expenditure affordability assessment. The friendly team members at Forward Finance will discuss your affordability with you to ensure that the product is suitable for you.

Repaying Your Vouchers

The repayment terms are exactly the same as our cash loans and you have the same options to make your repayments. You can choose to repay your voucher in a number of ways such as home collection, standing order or regular card payment; we allow you to choose the payment option that suits your requirements.

Apply for Vouchers in St. Albans With Forward Finance

If you’re based in St. Albans or any of the surrounding areas and are interested in applying for a high street voucher, then be sure to get in touch with us today. Just like our loans, you can choose to repay in the most convenient way that suits you. For more information on the vouchers we offer, please don’t hesitate to get in touch with us today.

Offering Voucher Loans Across St. Albans

Frequently Asked Questions About Voucher Loans St. Albans

I Know I Had Money on my Voucher Card, but it was Declined when I Tried Using it – What Can I Do?

If the amount of a proposed purchase is greater than the available balance, your card will be declined. You must inform the cashier that your purchase is greater than the balance on the Love2shop Plastic Gift Card and ask to pay the difference by cash or another payment method acceptable to the retailer first.

Can I Receive a Refund If I Return a Product Purchased Using a Voucher?

Depending on the retailer’s own refund policy, the store may either credit the refund amount back to your card or issue their own store vouchers/gift card/credit note.

Why Should I Choose Forward Finance for Vouchers in St. Albans?

There are a number of benefits when it comes to choosing Love2shop voucher loans. As lenders, we are fully certified and have the licenses needed to be able to provide you with voucher loans straight to your doorstep. As well as the above there is a number of other advantages to choosing voucher loans with Forward Finance this includes:

- Expert Team – With Forward Finance you can discuss your finance with a fully qualified agent, face to face, in the comfort of your own home, your convenience is important to us.

- On Hand to Assist – Any and all of your questions can be dealt with right there and then. You’ll also have the option to discuss anything in detail and at a time where it’s convenient for you.