Collection methods & implication of non payment

You can pay your loan account by debit card, standing order, or cash collected by our agents. Whichever method you choose, we will set up a payment plan to suit you.

If you pay by debit card, called the Continuous Payment Authority (CPA) we will;

- Automatically debit your card. You will never miss a payment and will automatically keep your loan agreement up to date.

- Payments setup as per your request.

- If you need to stop or change the payment please call us the day before and we will be happy to rearrange.

- There is no fee for this service and no card surcharge will be added. It is a completely free service.

- You can cancel the CPA at anytime with ourselves or via your bank. (Please be advised that if you do cancel this you will have to make other arrangements to repay your account).

- Your card details will be encrypted and stored securely.

We know that sometimes circumstances can changes which may affect your ability to make your agreed payments. If things do become a bit difficult and you are having financial issues, please get in contact with us or your agent to discuss your situation. As we deal with our customers on a personal level we are always on hand to discuss, guide and help through any difficult periods . If things are proving really challenging then we would recommend you contact one of the fee free debt advice services like StepChange, PayPlan or your local Citizen’s Advice Office.

If you cease payments you need to be aware that this could make obtaining credit more difficult and may lead to legal proceedings.

If we feel we need to proceed to enforcement we reserve the right to charge you the follow:

- default interest on any instalments in arrears for such period as they are in arrears at 25% per annum.

- for Letters/Notices sent to about your default at £12.00 each.

- any fees we incur in the instruction or involvement of third parties for, tracing you, returned payment, debt collection & court action.

Important legal aspects

You have a right to withdraw from the credit agreement before the end of 14 days beginning with the day after the day on which the agreement is made, or if information is provided after the agreement is made, the day on which the borrower receives a copy of the executed agreement under sections 61A or 63 of the Consumer Credit Act 1974 or the day on which the debtor receives the information required in section 61A(3) of that Act, whichever is the latest.

Early repayment

You have the right to repay the credit early at any time in full or partially and may be entitled to a rebate if you do so.

Consultation with a Credit Reference Agency

We reserve the right to use a credit reference agency but will inform you beforehand if we do so. If we decide not to proceed with your application on the basis of information from a credit reference agency we will inform you.

Renewals & Increases

All increases and renewals are not automatic and will have to cleared with our underwriting department. You can speak to your agent or our office for more information.

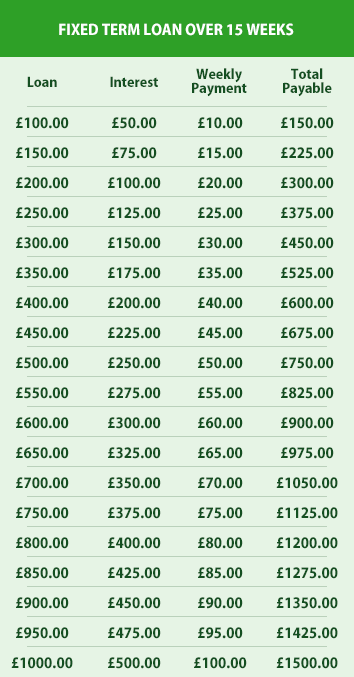

15 Week Loan Representative Example

- £100 loan repayable over 15 weeks at £10.00 per week

- Total repayable: £150

- Representative APR: 1564.2%

- Rate of interest: 173.81% p/a fixed

21 Week Loan Representative Example

- £100 loan repayable over 21 weeks at £7.50 per week

- Total repayable: £157.50

- Representative APR: 916%

- Rate of interest: 142.78% p/a fixed