Frequently Asked Questions

How much can I borrow?

Forward Finance offer loans up to £1000.00.

How do you assess affordability?

We proud ourselves in being responsible lenders, so will take into consideration your income and expenditure, we will want to see bank statements and proof of income and take into account other financial commitments you may have.

How long does the application take?

On receipt of the completed application and paperwork, we endeavor to turn around your application within 24 hours, if not sooner.

Do you use credit reference agencies (CRAs)?

Forward Finance uses the information you have supplied us with to assess your ability to afford a loan and to meet regular payments. We do not automatically process application through CRAs but reserve the right to do so.

When can I have an increase?

Increases on loan amount have to be approved and subject to an affordability assessment. We recommend you contact your agent or our offices regarding any increases.

I can’t get hold of my agent, what should I do?

If our local Hertfordshire agents are unavailable, you can call our office on 01442 266614 or contact us via

Facebook or Twitter

What are the methods of repayment?

Our methods are cash, cheque paid via our agents at the door and standing order or debit card collection known as the Continuous Payment Authority (CPA).

What is the Continuous Payment Authority (CPA)?

This allows you to pay your account via your debit card on a recurring basis. We will securely capture and encrypt your card details and set the payment of your loan on the date/date and frequency you tell us. If the payment misses or declines, our agents will make contact the same day to try and get the missed payment resolved. There are no extra charges for missed payments.

Are there any other charges?

Any additional charges are as per your loan agreement. Your agent will go through the full details of the agreement before you sign.

Can I pay the loan back fortnightly or monthly?

Yes, when the loan is approved, our agents will discuss which payment frequency is most beneficial for you.

Can I repay my loan early?

Of course you can!! There are no early repayments penalties and you may even get a rebate.

What happens if I am struggling to pay my loan?

Come and talk to us we are here to help. Forward Finance will discuss your circumstances and are happy to arrange a reduced payment for a short period until your situation improves. There are no additional charges added.

What areas do you cover?

We have local agents ready to help you in the Hertfordshire areas of, St Albans, Welwyn Garden City, Hatfield, Hemel Hempstead, Harpenden, and surrounding villages of these areas.

I have a complaint, what should I do?

In the first instance always contact us and we will endeavor to resolve your complaint.

Are Forward Finance members of any trade bodies?

Yes we are! We are members of the:

Consumer Credit Association (CCA)

Does Forward Finance follow a code of conduct?

Yes we do! Forward Finance are bound by our trade association the Consumer Credit Association’s (CCA) code of conduct.

Any other questions?

If you have any other questions or feedback we would love to here from you. You can call our offices on 01442 266 614 or speak to your agent (if you are an existing customer).

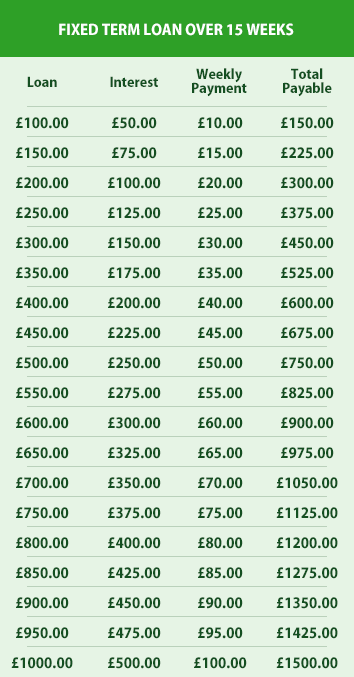

15 Week Loan Representative Example

- £100 loan repayable over 15 weeks at £10.00 per week

- Total repayable: £150

- Representative APR: 1564.2%

- Rate of interest: 173.81% p/a fixed

21 Week Loan Representative Example

- £100 loan repayable over 21 weeks at £7.50 per week

- Total repayable: £157.50

- Representative APR: 916%

- Rate of interest: 142.78% p/a fixed