Loans Radlett

The team at Forward Finance offers short term, personal loans that have affordable repayments. As a personal loans company, we cover the whole of the Radlett area and the surrounding areas. Our loans offer affordable repayments and have zero hidden fees or charges. If you are based in the Radlett area and are looking for a short – term loan? Then why not see how Forward Finance can help you.

We have been offering short term loans to people living in and around the Radlett area. No matter what your reason is for needing a loan, Forward Finance can offer you a short-term solution. If you would like to find out more information on the services we offer or how we can help you, be sure to get in touch with our team today!

Short Term Loans in Radlett

At Forward Finance we understand that in some months your money may be stretched; whether it be from having to pay unexpected costs or needing some extra to pay for something special. We have been able to help many people in the Radlett and neighbouring areas.

Whether you have a poor or bad credit score or not, don’t hesitate to get in touch with one of our friendly and advisable team members today. It is important to be open and honest about your credit history and score with us as these will appear on your credit report. We will then use the credit report to see that existing or previous debts have been or are being repaid.

Personal Loan Services

Here at Forward Finance we aim to provide a stress-free, simple and efficient loan service to customers throughout Radlett. The team here do their utmost to accommodate all requests through the wide range of comprehensive loans that we offer. We make sure that our team will only offer you a loan that suits our budget and your personal situation. With our effective and efficient loan service we aim to have your loan to you within 24 hours.

When you choose Forward Finance for a loan in Radlett or the surrounding areas, you will have the option to repay your loan in easy, affordable and straight forward installments. Our repayment plans are available from 24 weeks right through to 32 weeks. Should you be looking to apply for a loan in Radlett you can rest assured that our team will go above and beyond for all of our customers. To discuss your loan requirements in more detail or if you have any questions about the loans we provide simply call the team at Forward Finance today.

Local Radlett Loan Company

At Forward Finance our aim is to make the process as smooth and simple as possible for our clients. We’ll help to take away the stresses of needing a small amount of cash, in and around the area of Radlett. For more information simply call our professional loan advisors today, they’ll be more than happy to assist. Our assessments are quick and easy, and we’ll be able to determine quickly whether our short-term loan service is the right choice for you. After this we will arrange to meet and discuss your options further, this is all done at a time which is convenient for you.

Offering Doorstep Loans in Radlett

Doorstep loans, also known as home credit loans, are a type of personal loan. As the name suggests, the cash loan is delivered to your doorstep. A member of our dedicated team will then come around to your home on a weekly basis to collect your loan repayments.

This form of lending means:

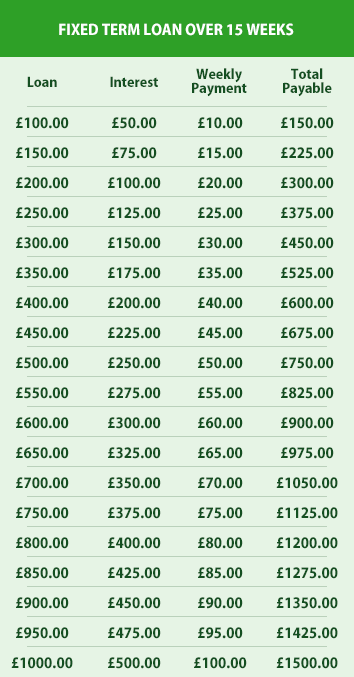

- Small cash loans of £100 to £1000 for new customers subject to affordability.

- Loans are managed on face to face basis by team members/agents visiting you at home

- Repayments are fixed weekly amounts for a fixed number of weeks (typically 13 to 52)

- No hidden costs or charges – even if you miss a payment or two

Flexible Cash Loans

If you are in need of instant cash loans, payday cash loans, whether they be big or small cash loans, in Radlett be sure to choose the team at Forward Finance today. If you have found yourself in a financial predicament and unsure what steps to take next? Whether you need money for car repairs or an appliance has broken, a cash loan may help your circumstances.

At Forward Finance our quick cash loans are designed for those financial emergencies, reflecting the urgency of when borrowers need them. When you apply for a cash loan online, you should receive an instant decision on your application as to whether or not you have been approved by one of our lenders.

Our Short-Term Loans Process

At Forward Finance our aim is to make the process as smooth and simple as possible for our clients. We’ll help to take away the stresses of needing a small amount of cash, in and around the area of Radlett For more information simply call our professional loan advisors today, they’ll be more than happy to assist. Our assessments are quick and easy, and we’ll be able to determine quickly whether our doorstep loan service is the right choice for you. After this we will arrange to meet and discuss your options further, this is all done at a time which is convenient for you.

At Forward Finance our short-term loan process for those based in Radlett is simple and straightforward. Our team of friendly advisors will make the loans process as easy to understand as possible, our process works in the following way:

-

- Step One: When you decide to go ahead with our loans process, one of our team will take your name, address and phone number. We will need to visit your home to discuss our loan products, we will need to request a call-in order to do this (you can do this on our application page).

- Step Two: Your details will then be passed on to one of our friendly agents will then contact you to arrange completion of the full application and documents.

Step One:Once we have received your full application and documents, we will process your application for a decision - Step Three: If the loan is approved, we will explain the offer, loan amount, the terms, interest rate, repayment and all aspects of the loan. You can then decide if you wish to proceed or not.

- Step Four:If you are then happy to proceed to our agreement, one of our agents will arrange a visit to you, complete the loan agreement, arrange the repayment method and give you your cash.

Once you become a Forward Finance client you are given a credit limit and provided your account is maintained in good manner, you can use this facility whenever required. NB subject to status & affordability check.

Why Choose Us for Cash Loans in Radlett?

There are a number of benefits when it comes to having personal loans sent to your bank account. As lenders, we are fully certified and have the licenses needed to be able to provide you with cash loans straight to your doorstep. As well as the above there is a number of other advantages to personal loans from Forward Finance this includes:

-

- Expert Team – With Forward Finance you can discuss your finances with a fully qualified agent, face to face, in the comfort of your own home, your convenience is important to us.

- On Hand to Assist – Any and all of your questions can be dealt with right there and then. You’ll also have the option to discuss anything in detail and at a time where it’s convenient for you.

- Loans Direct to You – When you choose our team, you can receive the money in cash and through a quick service, as well as your repayments being collected from one of our agents.

For Short Term Loans in Radlett, Contact Forward Finance

Apply for a Short-Term loan today and discover the many benefits that you can receive from this method of a personal loan. Our aim is to make things easier for our clients in Radlett, and so this personal loan could be a quick solution to your problems. Call us now to learn about our terms and conditions, or for any other enquiries. We will be more than happy to assist you. For many years the team at Forward Finance has provided Short-Term loans to many people in Radlett, all of who have been in different financial situations, over the years. Give our team a call today and we can find out if we can help you today.

We offer loans across Batford, Borehamwood, Berkhamsted, Leavesden, Dunstable, Luton, Harpenden, Kings Langley, Bovingdon, Bricketwood, Welham Green, Sandridge, Stevenage, Wheathampstead, Tewin, Pimlico, Colney Heath, Radlett, Lemsford, Crouch, Childwickbury, Knebworth, Datchworth, Whitwell, Redbourn, Woolmer Green, Nash Mills, Brookmans Park, St Albans, Hatfield, Garston, Bramfield, Watton-at-Stone, Codicote, Park Street, Aldenham, London Colney, Batchwood, Cunningham, Abbots Langley, Markyate, Frogmore, Bedmond, Welwyn Garden City, Hemel Hempstead, How Wood and many more.

Offering Short Term Loans Across Radlett

Loans Radlett – Frequently Asked Questions

What is a Short-Term Loan and How Do They Work?

Short Term loans are loans that are repaid over a shorter period where you can borrow a sum of money and repay this over a set time with fixed and affordable repayments. The lender will charge you interest to lend you the money which means you will repay the amount you borrowed plus the interest. The advantage of a personal loan is that you can spread the cost of a purchase with affordable repayments over a period. Unlike a traditional bank loan, which is usually paid back over several years, a short-term loan is designed to be paid back often within several months. They can be used for emergencies, such as car repairs or broken boilers. You agree with an amount you can afford to borrow with your chosen lender, which will include the interest rate and total amount you are expected to pay back.

Who Can Apply for a Personal Loan?

Any adult over the age of 18, living in the UK, with a bank account, can apply for a personal loan. However, not every applicant may be accepted. Our team will perform a credit check and an affordability check to make sure you can afford to take on the loan you are requesting. If the requested loan is judged to be beyond your financial reach, you will not be accepted.

What is Bad/Poor Credit?

Almost everyone over the age of 18 has a credit report in the UK. This is a log of information which details you to use of credit, including information on everything from unpaid phone bills to credit card usage, debt management and much more. Lenders, such as Forward Finance, we will then use this information to gauge whether you are a responsible user of financial products and to decide whether you’re able to make repayments on a loan. If you have bad credit, you may find it difficult to access financial products such as payday loans. Bad credit can take many forms; missed or late payments stay on your credit report for six years, as do county court judgments for non-payment and bankruptcy. People you are linked to financially can also harm your credit rating. If your spouse has bad credit and you have a joint mortgage, their credit report will be available to view and could harm your access to credit. Failing to repay a payday loan on time will harm your credit rating, making it more difficult to access any type of credit in the future.

What if I Have Bad Credit?

We appreciate that a bad credit score isn’t reflective of you as a person – it can happen to anyone. If you have a poor credit history, Loans at Home won’t judge you on this and you may still qualify for short term loans. If you apply to borrow money, we look at more than just your credit score, so bad credit may not hold you back.

What is a Cash Loan?

At Forward Finance our cash loans are a small loan which can be available incase of an emergency. Our cash loans are quick and usually unsecured, this means we don’t require you as the borrower to secure your loan against an asset. With Forward Finance it has never been easier to apply online for a cash loan. Our application process has been specifically designed for ease of applying in an emergency, meaning you don’t have to worry about filling out long forms or wasting any time sending over paperwork.